Tax season can be a stressful time, and unfortunately, it’s also a prime time for identity thieves to strike. With the rush to file taxes and the abundance of personal and financial information being shared, it’s easy for bad guys to steal your identity and cause major headaches for you down the line.

Tax season can be a stressful time, and unfortunately, it’s also a prime time for identity thieves to strike. With the rush to file taxes and the abundance of personal and financial information being shared, it’s easy for bad guys to steal your identity and cause major headaches for you down the line.

How Identity Thieves Target Taxpayers

Identity thieves use a variety of tactics to target taxpayers this time of year. One common approach is to send phishing emails that appear to be from the IRS or other government agencies. These emails may ask you to verify your personal or financial information, or they may contain links to fake websites that look like legitimate ones. Once you enter your information, the bad guys can use it to file false tax returns or open bank accounts and credit cards in your name.

Fraudsters aren’t afraid to go through your mail, or even your trash, to look for hard copies of your documentation either. They often look for documents containing your Social Security number, bank account information, or other sensitive details that can be used to steal your identity. Always shred any documents or information that contains personal data.

Finally, it is not unheard of for bad guys to pose as tax preparers, the IRS, or financial advisors to obtain your information. Only work with people that have been thoroughly vetted, and ideally are referred to you from a friend or colleague.

How to Safely Send Information to Your CPAs

If you’re working with a CPA or tax preparer, take extra precautions to protect your information.

- Use a secure file sharing service to send and receive documents. (Most CPAs now offer this as part of their service.) Avoid sending sensitive information via email, which can be intercepted by hackers.

- If you are working with a new provider this year, verify that your CPA is legitimate before sharing any information. Check their credentials and reviews online and ask for references if possible.

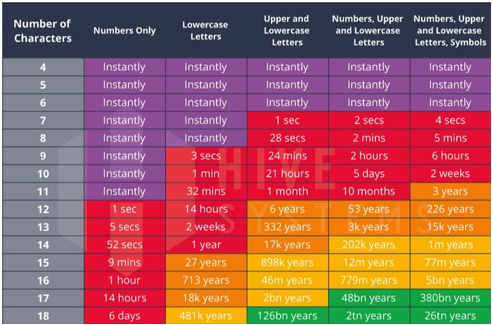

- Use strong passwords and two-factor authentication to protect your online accounts.

What to Look Out For

To protect yourself, remain vigilant and aware of the warning signs.

- Unsolicited emails or phone calls from someone claiming to be from the IRS or another government agency. According to their website, the IRS will always mail a letter (or several) to you before contacting you in any other way.

- Requests for personal or financial information via email, phone, or text message, especially those that sound dire or urgent in nature.

- Suspicious activity on your credit reports or bank accounts

- Missing mail or documents that contain personal information

- Errors or discrepancies on your tax returns or other financial statements

What to Do if You Become a Victim

If the worst happens and you are successfully targeted, it’s important to act quickly to minimize the damage.

- Contact the IRS and other government agencies to report the fraud and obtain assistance with resolving the issue.

- Notify your bank and credit card companies to monitor your accounts for suspicious activity.

- Place a fraud alert or freeze on your credit reports to prevent new accounts from being opened in your name.

- File a police report and keep a record of all communication with law enforcement and other agencies.

- Consider enrolling in an identity theft protection service to monitor your accounts and help you recover from the fraud.

Be careful this time of year so you don’t wind up paying way more than you owe to the IRS.