With the holidays quickly approaching, I know I’m already starting to stress about what to buy friends and family for Christmas. In many instances, my siblings and I go in together on gifts for our parents, and sometimes the most difficult part is settling up with them afterwards. It sometimes can get confusing, especially if you wait until March to repay them… whoops! Similarly, if you go out for a holiday dinner with friends and you owe someone money afterwards, you certainly don’t want to write them a check or worry about going to the ATM and finding change to get the exact amount. So, what are your options?

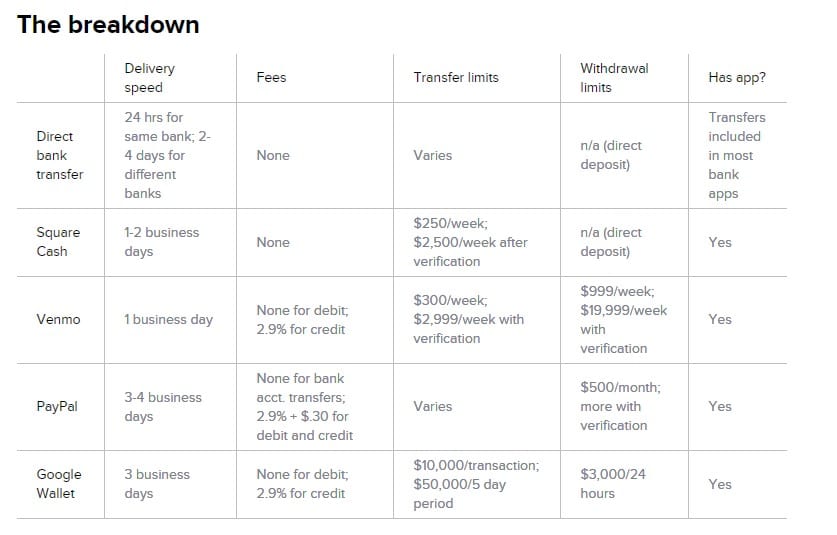

There are many services on the market today that allow you to transfer money quickly. The most well-known are a direct transfer from your bank, or PayPal. I have had problems with bank to bank transfers in the past. Sometimes a transfer is not always possible if the person you are trying to send to or receive money from has, for example, an account with a credit union or a smaller bank. Below you’ll see a breakdown of the many services on the market today, courtesy of cnet.com. For pros and cons of each, you can visit the full article at Five ways to get people to pay you back.

Personally, I have used bank to bank transfers (but as I mentioned above, I can only do that with certain people), PayPal, and Venmo. PayPal treated me well, but I wasn’t receiving my money as quickly as I would like. Also, if you choose to pay with a debit or credit card versus paying directly from your bank account, you get charged a fee.

Personally, I have used bank to bank transfers (but as I mentioned above, I can only do that with certain people), PayPal, and Venmo. PayPal treated me well, but I wasn’t receiving my money as quickly as I would like. Also, if you choose to pay with a debit or credit card versus paying directly from your bank account, you get charged a fee.

Recently, I have been using Venmo which I have found to be very user-friendly. When signing up for a free account, you can easily link your bank account or debit card, free of charge (note: most major debit cards are free of charge, but you can check on the Venmo website to see if your bank is included). However, if you choose to pay via credit card, you’ll incur a 2.9% fee.

When signing up, you can link your account with your phone contacts and/or Facebook friends, who are most likely the people with whom you will be exchanging money. If someone is not in your contact list, you can easily send them a note via text or email. Also, if the person with whom you are doing business is nearby, you can search Venmo’s “Nearby” option to find them.

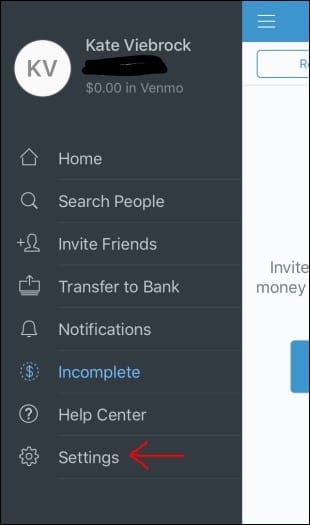

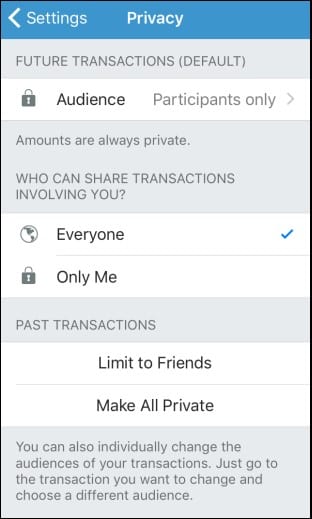

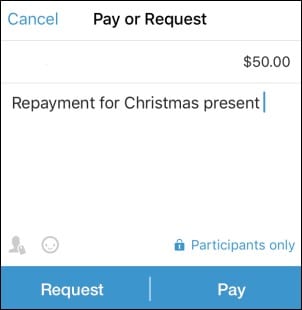

Before sending or receiving your first payment, I highly recommend checking your privacy settings. Venmo is setup with a strong social element so when you first open your account, the privacy settings are open so everyone, and I mean EVERYONE, can see your transactions. I’m not just talking about your Facebook friends which your account may be linked to, but you can see everyone globally. When I sent my first payment, it was included on the main page, and I also noticed an old roommate who received money, and some other friends. I certainly don’t want everyone knowing what I’m doing with my money. Simply enough, I found the privacy options. Go to Settings, then Privacy & Sharing, then you can change your audience settings and who can share transactions with you. I changed my privacy settings to Participants only, which is between the sender and recipient.

Before sending or receiving your first payment, I highly recommend checking your privacy settings. Venmo is setup with a strong social element so when you first open your account, the privacy settings are open so everyone, and I mean EVERYONE, can see your transactions. I’m not just talking about your Facebook friends which your account may be linked to, but you can see everyone globally. When I sent my first payment, it was included on the main page, and I also noticed an old roommate who received money, and some other friends. I certainly don’t want everyone knowing what I’m doing with my money. Simply enough, I found the privacy options. Go to Settings, then Privacy & Sharing, then you can change your audience settings and who can share transactions with you. I changed my privacy settings to Participants only, which is between the sender and recipient.

When you send money, you can send it directly from your debit card, bank account, or your Venmo account if you have funds in it. When you receive money, it is automatically added to your Venmo account. From there, you can transfer it to your bank account, or leave it in your Venmo account to pay someone else at a later date. Simple as that!

When you send money, you can send it directly from your debit card, bank account, or your Venmo account if you have funds in it. When you receive money, it is automatically added to your Venmo account. From there, you can transfer it to your bank account, or leave it in your Venmo account to pay someone else at a later date. Simple as that!

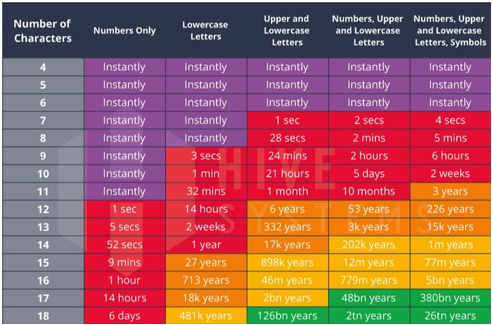

I know many people are concerned with internet security due to the recent online hacking scandals, so before you use one of these electronic transfer services, do your homework. Don’t make your password the same as your email password and make sure it is strong. For a reminder on passwords, be sure to re-read Tuesday Tip: Managing Strong Passwords.

These electronic transferring services aren’t for everyone so if you want to send money electronically, choose one that fits your needs. If you prefer to write a check or withdrawal cash, power to you! Happy shopping and here’s hoping you get repaid for holiday presents before March!

With multiple years’ experience working with clients in many industries, Kate brings her skills and positive attitude to Network 1’s team, clients and partners. She strives to provide the best service and solutions to her clients so they can achieve greatness through Worry-Free IT.

kviebrock@network1consulting.com or 404.997.7653

Network 1 Consulting is a 17-year-old, IT Support company in Atlanta, GA. We become – or augment – the IT department for law firms and medical practices. Our IT experts can fix computers – but what our clients really value are the industry-specific best practices we bring to their firms. This is especially important with technology, along with regulations and cyber threats, changing so rapidly. We take a proactive approach to helping our clients use technology to gain and keep their competitive advantage.

Keep up with our latest tips at: